The Revenue Department of Thailand has recently launched a new tax law on interest payments in savings accounts owned by foreigners.

The Revenue Department taxes 15% of the amount of all interest payments which are usually paid in June and December.

Many foreigners who are taxed in the South East Asian country may not be able to reclaim the tax as the requirements are quite strict to reclaim the tax.

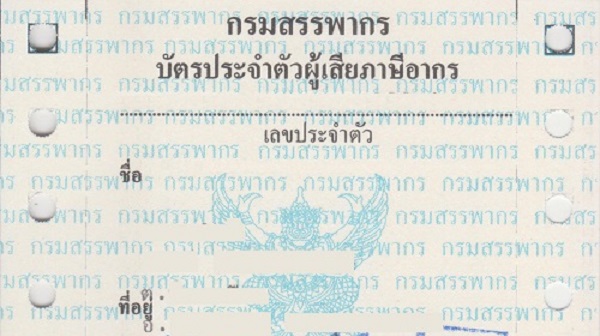

All tax claims can only be initiated with a Tax ID (also called a TIN card)

Example of a Tax ID in Thailand:

Thai Advice is a service where you can find more details on document processes in Thailand.

It has never been so important to get your Tax ID than now.

Thai Advice can aid with the following:

– Tourist visa requirements

– Non-O visas based on marriage visa requirements

– Work permits

– Yellow Tabien Baan (house registration book). Blue house book (adding a name).

– Pink foreign ID card

– Details about visas at various Embassies in Bangkok

– Thai Tax ID or (TIN card)

– Tax return details

– Drivers licenses (car and motorcycle) (temporary and full 5 year one)

– Obtaining medical certificates

– Opening various banks in Thailand. Detailed banking information.

– Police clearances within Thailand

– Police report requirements

Contact Thai Advice.

South Africa Today – South Africa News