How much personal tax is too much tax to pay?

Total government spending in 2020 was approximately R2 trillion according to Stats SA. In an article published by businesstech.co.za (25 May 2021), it was stated that the expected cost of 18 million social grants (a month) would be an annual figure of R195 billion for 2021/22. This equates to approximately 10% of all government expenditure. Put differently, of every Rand spent by government, approximately 10 cents are allocated to social grants. This represents a significant outflow of government funds that could be used for other productive functions such as improving the economic infrastructure to create more jobs. Presently, the Q4 2021 official unemployment rate stands at 35,3%, an unwanted record high. This is a telling figure as it illustrates how many people are currently unable to partake in the economy and it also describes how few individuals contribute towards personal income tax. The persistent growth in the unemployment rate is a worrying sign as more people join those who require grants, supported by employed people who contribute to the tax base. The picture gets worse when one considers that government plans to roll out the National Health Insurance (NHI) scheme and according to an article published by the Daily Maverick (23 March 2022) ‘Section 49 of the bill states that the NHI will be funded from the reallocation of medical scheme tax credits, general tax revenue, payroll tax and a surcharge on personal income tax.’ This statement implies that those with jobs and/or medical aids will once again dig deeper into their pockets to fund the NHI. At what point do those paying taxes decide enough is enough and alter their tax behavior to either avoid or worst of all evade taxation?

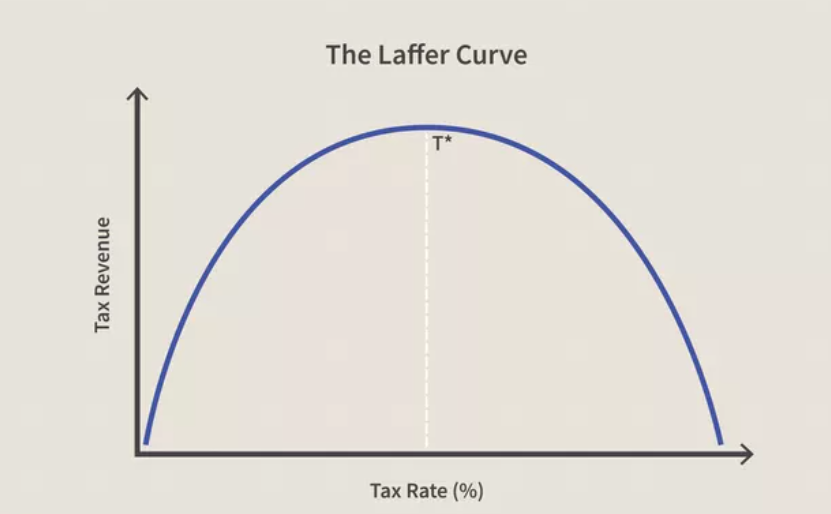

The Laffer Curve is an economic construct that illustrates that as tax levels rise, they eventually hit a sweet spot before over-taxation reduces the total value of tax revenue collected through avoidance or evasion. A common reason for this is that the taxpayers begin to rebel against the tax system as they feel that their tax levels are unjustified. A local example of this is the rebellion against E-Tolls. Many taxpayers are of the belief that they already pay for toll roads via the fuel levy and therefore view E-Tolls as double taxation. This is a contributor to the low levels of E-Toll collection that SANRAL currently experiences. The Laffer Curve below illustrates that at point T* the country in the example is at its optimal tax rate that maximizes revenue collection. Any point to the right thereof illustrates how taxpayers become more rebellious as the tax rate increases beyond the level at point T*.

*Source: Investopedia

Is South Africa at level T*, before it, or after it? The above curve is an economic principle which although easy to discuss is difficult to measure at national level. The evidence would suggest that South Africa is at point T* or past it as many articles have been dedicated to the high tax levels faced by South Africans showing that this is a sensitive and current topic The fuel levies have most recently come under fire and have been relaxed in the short term to provide consumers with some breathing room. If this evidence is in fact indicating that SA’s tax rates are reaching a ‘boiling point’ then how should the government approach the problem sustainably? The answer is to expand the tax base rather than to increase existing taxes. But how can tax revenue be increased without hitting those that are already feeling the crunch caused by the existing tax model? This is where some creative policy making can have a positive impact. One such positive policy is the decrease in the companies tax rate that will make SA a more attractive location to setup businesses and hence employ staff (adding new jobs to the economy and hence expanding the tax base). The expectation here is that the one percentage point in companies tax revenue given up will be offset by the resulting added benefits gained in the economy by it becoming more attractive to setup a business in South Africa.

Ultimately, the net effect of any change to the tax system should be taken into account when making any decisions on how to alter government expenditure. Although those that are ‘fortunate enough’ (because they have jobs) to be able to pay tax must do so, there will come a time when they refuse to do so if tax rates increase to intolerable levels. Government should take heed of this message when deciding on new sources of funding as the tax paying citizen is not an endless supply of funding or beware the consequences.

Written by:

Bryden Morton, B.Com (Hons) Economics, Executive Director – [email protected]

Chris Blair, B.Sc Chem. Eng., MBA – Leadership & Sustainability, CEO – [email protected]

About 21st Century:

21st Century, a level 2 BBBEE company, is one of the largest Remuneration and HR consultancies in Africa, with a team of more than 60 skilled specialists, servicing over 1700 clients – including non-profit organisations, unlisted companies, government, parastatals and over two-thirds of the companies listed on the JSE. 21st Century offers bespoke business and strategy planning services, operating model and organisational design, creative reward practice modelling, change, stakeholder and culture management, training courses and comprehensive human capital and talent plans. These are all underpinned by our analytic and survey capability tailored to the African environment. 21st Century continues to offer solutions via a combination of virtual channels and on-site presence.

21st Century has expanded its services to offer a full turnkey sustainable business and remuneration service. Beyond remuneration and reward consulting, 21st Century offers local analytics for business advantage; remuneration and HR training; change management services; talent and people solutions; and end-to-end organisational design and development.

| Issued By: | The Lime Envelope |

| On Behalf Of: | 21st Century |

| For Media Information: | Bronwyn Levy |

| Telephone: | 076 078 1723 |

| E-mail: | [email protected]

|