A key differential should be made between the informal, formal and corporate sectors of employment in South Africa, Jaen Beelders Senior Analytics Advisor explains why…

“The informal sector refers to a subset of unincorporated enterprises comprising those that produce at least some output for the market; and are less than a specialised size in terms of the number of persons engaged or of employees employed on a continuous basis; and/or not registered under specific forms of national legislation, such as factories, or commercial acts, social security laws, professional groups’ regulatory acts, or similar acts, laws or regulations established by national legislative bodies.

“Formal sector employment and business are made up of all employing businesses that are registered in any way. The formal sector includes government, parastatals, registered non-governmental organisations and private businesses that are registered for either income tax or VAT.

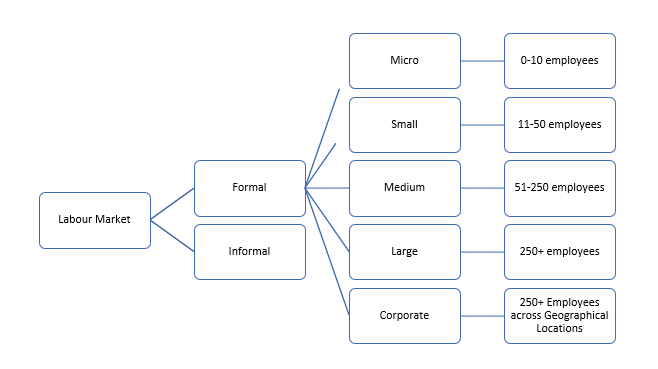

“Often Earnings Experts illustrate earnings scenarios that distinguishes between formal and corporate sector. This should not be the case since the formal sector comprises micro, small, medium and corporate companies. Corporate is defined as a legal entity that is separate and distinct from its owners and founders. A corporate has the same rights and responsibilities that an individual possesses. The term “corporate” has become synonymous with large business in South Africa and not defined by its legal standing. Considering the term corporate as a proxy for size and financial turnover the following characteristics would constitute the definition of corporate in South Africa:

- Registered legal entity with shareholders.

- Organisations that trade across multiple territories.

- More than 250 employees.

- Geographical operations.

Figure 1. Labour market sectors.

“Earnings experts would find it beneficial to rather segment the formal sector, as illustrated above, instead of comparing the formal sector to corporate employment. This would also assist in guiding the election of earnings resources to be used.”

Written by: Jaen Beelders, Senior Analytics Advisor

About 21st Century:

21st Century is one of the largest Remuneration and HR consultancies in Africa, with a team of more than 60 skilled specialists, servicing over 1700 clients – including non-profit organisations, unlisted companies, government, parastatals and over two thirds of the companies listed on the JSE. 21st Century offers effective business planning with KPA and strategic planning reviews, creative reward practice modelling, operating modelling, change, stakeholder and culture management, training courses and comprehensive organisational development plans. 21st Century continues to offer solutions via virtual channels during the lockdown period.

In this volatile and uncertain environment, the way of working is changing dramatically. There are new – and often unprecedented – challenges that require businesses to plan rapidly and take decisive and immediate action. 21st Century offers a Resilience Audit assessing businesses during COVID-19 for their sustainability, offering these businesses tailor made solutions and developing new remuneration structures and performance measurement systems.

21st century has expanded its services to offer a full turnkey sustainable business and remuneration service. Beyond remuneration and reward consulting, 21st century offers local analytics for business advantage; remuneration and HR training; change management services; talent and people solutions; and end-to-end organisational development.